MARKET AND ECONOMIC UPDATE - March Quarter 2024

March Quarter 2024

Key points

-

Equity All-Time Highs: Global and Australian equities have continued to rise in Q1 2024, with many major equity markets reaching all-time highs.

-

Bond Split: Australian bonds gained, and global bonds fell as markets reacted to economic data and central bank comments.

-

US Dollar Regains Ground: The US Dollar gained over the quarter while the Australian Dollar fell as expectations for US rate cuts were pushed back.

-

Cautious 2024 Outlook: Expect market volatility with a focus on diversified equities and medium-duration bonds.

-

Sector Performance: Technology outshone the rest of the market globally and even in Australia despite a lack of strong domestic investment options in the sector.

1. Markets in Review

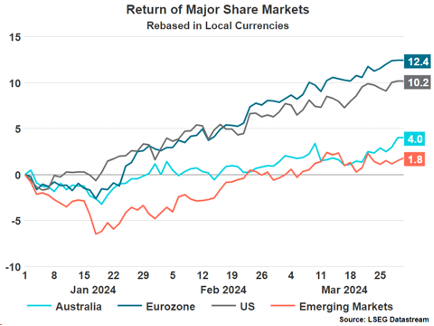

Entering 2024, investors exhibited caution as they waited to see the effects of aggressive rate hikes on the wider economy. Thus far, investors have been encouraged by the resilience of the global economy and subsequently all major equity markets finished positive for the quarter with many reaching all-time highs. The best-performing region was the Eurozone which benefitted from investors de-concentrating their portfolios away from the US where valuations continue to be stretched, especially in comparison to Europe which is currently trading at a discount. Despite this, the US still performed well over the quarter returning 10.2%, even with inflation not slowing as expected.

Fixed Income had a mixed month as we start to see divergence in different economies and sectors. The 10-year U.S. Treasury yield concluded the quarter at 4.2%, up by 32 basis points since the start of the year. This was a result of stronger than expected growth and stickier inflation leading fixed income investors to re-think rate cut predictions.

2. Returns

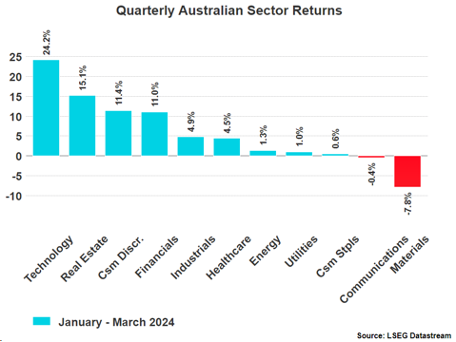

Throughout the first quarter of 2024 the S&P/ASX 200 returned around 4%, this pace being much slower than what we saw near the end of 2023 as strong economic data has pushed expectations for rate cuts back towards the end of the year. The strongest performing sector was Technology, returning 24.2%, as fervour surrounding the A.I. boom picked up speed. Despite this massive rate of return the sector’s performance had little effect on the overall S&P/ASX 200’s performance due to the Technology sector making up just 2.86% of the index. Real Estate also continued to perform well due to the expectation that we are at peak interest rates and approaching the first rate cuts.

The only sector that meaningfully retracted over the quarter was Materials (-7.8%) which can largely be attributed to a reduction in the price of iron ore. An interesting scenario has arisen around gold miners, whose share prices have failed to keep up with the rise in the price of gold itself. This divergence likely stems from an increase in production costs due to higher labour costs.

3. Foreign Exchange Markets

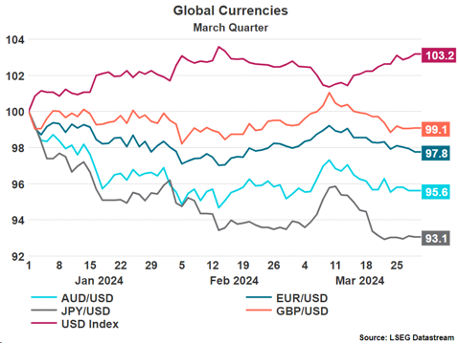

In contrast to the last quarter of 2023 the USD dollar index (DXY) against a basket of currencies strengthened by 3.2% over the first quarter of 2024. This occurring due to strong economic data out of the US and comments from the Federal Reserve leading investors to push back their expectations of rate cuts in the first half of 2024. As rate cuts are expected later, bond yields remain elevated, attracting investors to the USD and increasing its relative value. This has led to a depreciation of the Australian dollar against the USD of 4.4% from 0.68 to 0.65.

The currency that depreciated the most against the USD was the Japanese Yen (JPY), depreciating by 6.9%. A prolonged period of negative interest rates in Japan has had the effect of reducing the currency’s desirability amongst traders in our current environment of high interest rates in most developed countries. In Q4 the Bank of Japan finally acted and increased interest rates for the first time in 17 years from -0.1% to 0-0.1% in an attempt to stimulate the economy.

4. Fixed Income Markets

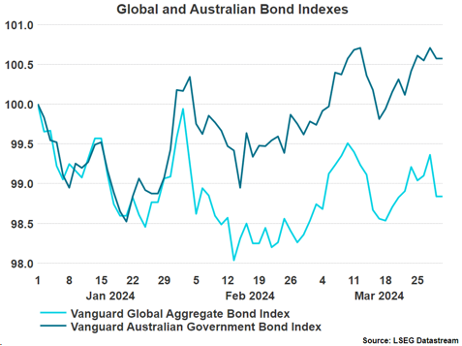

It was a volatile quarter for fixed income as strong economic data and central bank comments fought investor expectations for rate cuts, but in the end Australian bonds ended up by just 0.57% while global bonds ended down by 1.16%. Australian bonds gained over the quarter due to the belief that central bank rates have reached their peak, and that the RBA is simply waiting on the data to reflect inflation returning to the 2-3% target band before they begin to cut rates. The US reached the same position late last year, but the data has continued to suggest that inflation is not yet under control, meaning rates must remain elevated, leading to a decline in the price of bonds.

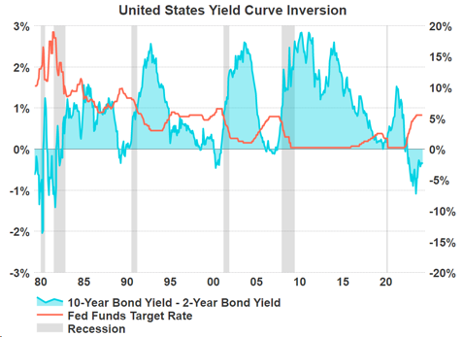

The US continues to have a yield curve inversion, the longest by far in the last 40 years. The inversion which was previously shrinking has slightly expanded again as the expected date of the first Federal Reserve rate cut continues to be delayed. A yield curve inversion is a common recession indicator in the US with every inversion in the past forty years being followed by a recession. With the latest inversion being longer than most that came before investors are waiting to see whether the indicator remains true.

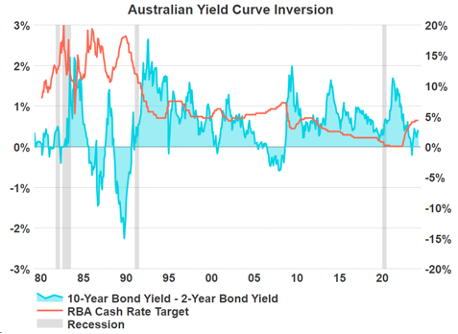

The Australian yield curve has normalised for quite some time now, but we are still waiting to see whether Australia will enter a recession or narrowly avoid one as inflation slows.

5. Outlook

Our outlook for the rest of 2024 remains much the same as it was at the start of the year. We initially predicted in January 2024 that most of the expectations for rate cuts around halfway through the year were far too optimistic, which has proved to be the case as many outlets have pushed their predictions back. We continue to predict that inflation will become stickier the closer we come to the RBA’s 2-3% target band, which has been clear to us in the strength of the labour market and the general economy during this first quarter of the year. Our belief is that given the RBA lagged the other central banks with lifting interest rates (in particular the US), they will also lag other central banks on the way down.

Regarding equities, we continue to expect volatility as rate cuts fail to arrive for most of the year. This does not mean that equities cannot perform well between data releases and central bank meetings, but we believe there will be greater volatility. In order to allocate your portfolio effectively in light of this prediction we continue to suggest a well-diversified equity portfolio, allowing access to any broad market rallies while limiting exposure to rate-sensitive sectors that may exhibit more of the aforementioned volatility.

It is a time for some slight caution in fixed income as central banks watch inflation data closely to determine their next course of action, so we suggest a medium-duration approach to fixed-income investing. While it seems unlikely at the moment that central banks will raise interest rates once more, if the data suggests that inflation is resurging then they will have little other choice. It is due to this slight chance that we suggest a slight overweight to duration. This approach should prove beneficial in a scenario of interest rate cuts while also providing a healthy income in the more likely scenario that rates remain at their current level for a longer period of time before they are eventually lowered.