April 2024

How the different asset classes have faired:

(As of 30 April 2024)

|

Asset Class

|

10 Yr

% p.a.

|

5 Yr

% p.a.

|

3 Yr

% p.a.

|

1 Yr

% p.a.

|

YTD

%

|

6 Mth

%

|

3 Mth

%

|

1 Mth

%

|

|

Cash1

|

1.83

|

1.55

|

2.19

|

4.24

|

1.44

|

2.17

|

1.07

|

0.35

|

|

Australian Bonds2

|

2.09

|

-0.48

|

-2.29

|

-0.88

|

-1.02

|

4.66

|

-1.23

|

-1.98

|

|

International Bonds3

|

|

-1.08

|

-3.95

|

-0.46

|

-2.57

|

4.10

|

-2.17

|

-1.95

|

|

Australian Shares4

|

8.06

|

8.38

|

7.15

|

9.94

|

2.61

|

15.97

|

1.52

|

-2.70

|

|

Int. Shares Unhedged5

|

13.03

|

12.41

|

12.06

|

20.80

|

10.35

|

17.38

|

5.64

|

-3.18

|

|

Int. Shares Hedged6

|

10.02

|

9.63

|

6.08

|

19.04

|

6.53

|

19.59

|

4.67

|

-3.17

|

|

Emerging Markets Unhedged7

|

6.15

|

2.91

|

-0.75

|

10.75

|

7.50

|

11.81

|

9.56

|

1.14

|

|

Listed Infrastructure Unhedged8

|

8.79

|

4.34

|

6.32

|

-1.50

|

3.30

|

7.90

|

3.11

|

-1.88

|

|

Australian Listed Property9

|

9.26

|

5.53

|

7.51

|

18.89

|

7.29

|

32.58

|

6.00

|

-7.64

|

|

Int. Listed Property Unhedged10

|

6.05

|

0.77

|

1.26

|

-0.26

|

-3.33

|

8.56

|

-2.39

|

-5.88

|

|

Gold Bullion Unhedged11

|

6.00

|

12.49

|

9.38

|

16.75

|

12.24

|

15.88

|

13.59

|

4.88

|

|

Oil Unhedged12

|

-10.19

|

-2.10

|

21.45

|

17.76

|

18.14

|

5.10

|

11.20

|

-0.13

|

1 S&P/ASX Bank Bill TR AUD, 2 Vanguard Australian Fixed Interest Index, 3 Vanguard Global Aggregate Bd Hdg ETF, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD, 11 LMBA Gold Price AM USD, 12 S&P GSCI Crude Oil TR

Source: Centrepoint Research Team, Morningstar Direct

Key Themes:

- Equity Markets had their first monthly decline in 2024: Both international and Australian equity markets retreated over the month as rate cut expectations were further delayed.

- Fixed Income falls: Both international and Australian bond prices fell, and yields rose following strong economic data and central bank comments.

- Australian Dollar flat: The Australian dollar ended the month at almost the exact same level that is started at.

- Commodities end mixed: Oil prices fell due to easing tensions in the Middle East, whilst gold continues to rise.

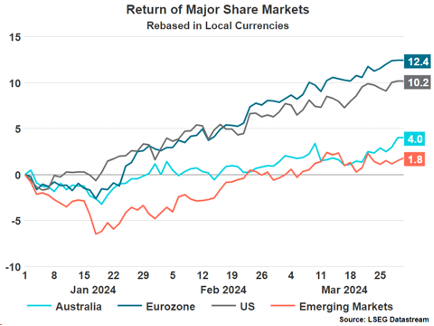

International Equities:

April was a rough month for international equities, ending a five month-long rally, with unhedged equities falling by 3.18% and hedged equities falling by 3.17%. The overall global market hit a low point in the month on the 19th of April at -4.8% but has slightly recovered in the last third of the month. This reduction was primarily fuelled by strong inflation and economic data coming out of the US convincing investors that the interest rate cuts that were previously expected to come around June will now most likely come much later in the year or maybe even in 2025.

The three worst performing sectors were Real Estate (-5.9%), Technology (-5.8%), and Consumer Discretionary (-4.3%), all three being highly interest rate sensitive sectors that have suffered from expectations of later rate cuts. The only global sector that ended the month with a positive return was Utilities which grew by 1.4%. This most likely being due to utility companies being able to raise their prices in line with inflation whilst maintaining their customer base, due to their products being mostly necessary for modern life. It may also partly be due to investors leaving their riskier growth investments and reinvesting in more defensive stocks in the Utilities sector.

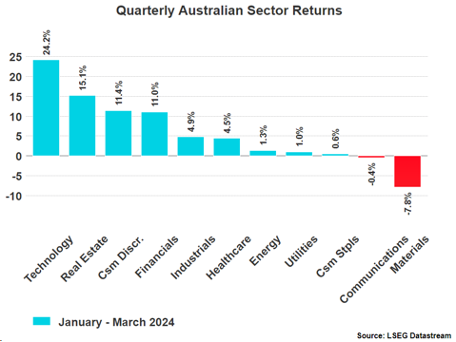

Australian Equities

The Australian equity market suffered less so than the global market in April but still retreated by 2.7%. This also being due to strong economic data out of the US and Australia pushing back the expected date of initial central bank rate cuts. Much like global equities the two biggest losers in April were Real Estate and Consumer Discretionary, losing 7.7% and 5.4% respectively, due to their sensitivity to interest rates. Both sectors have been strong performers over the past few months when rate cuts were expected sooner in the year but much of those returns were wiped out this month.

In Australia, once again similarly to global markets, Utilities was the best performing sector but by a significant amount, returning 4.9% in April. This can be attributed to the same reasons as why the sector outperformed the rest of the market globally. The next best performing sector, and the only other that had positive returns, was Materials, growing by just 0.5%.

In general, the biggest influences this month on both the Australian and global equity markets were strong economic data, rate cut expectations, and the threat of a greater conflict between Israel and Iran in the Middle East. This last factor adding volatility during the month, but its effect has mostly subsided as tempers seem to have settled.

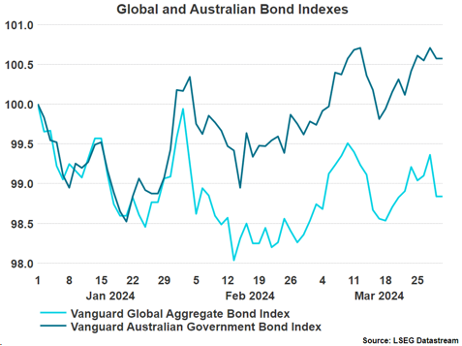

Domestic and International Fixed Income

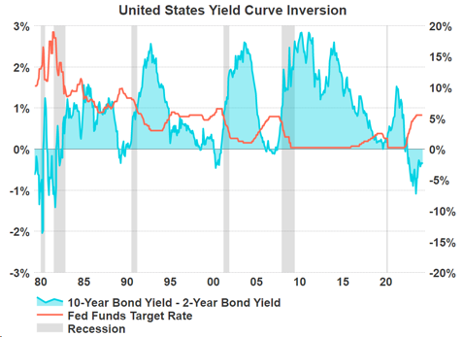

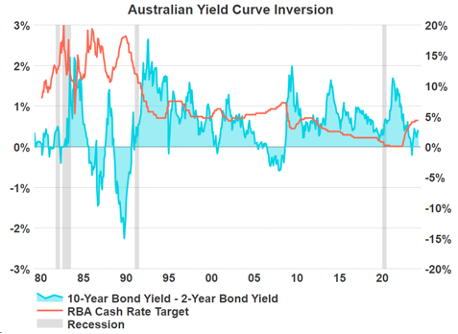

Throughout April international bond prices fell by 1.95%. The continued release of strong economic data and persistent inflation in the US has finally broken the expectations of investors, with many pushing back their expectations for rate cuts to September, November or even early 2025. This has led to an increase in the yield on 10-year US bonds by 8.2% and two-year US bonds by 6.7% which in turn has lowered the prices of bonds.

The story is very similar in Australian bonds as their price has fallen by 1.98%. This has been caused by the previously mentioned rate cut expectations in the US as well as our own economic data in Australia and Reserve Bank of Australia comments leading investors to believe initial domestic rate cuts will not arrive until 2025. This has materialised in the yields on 10-year and two-year bonds rising by 11% and 11.6% respectively and in turn lowering their prices.

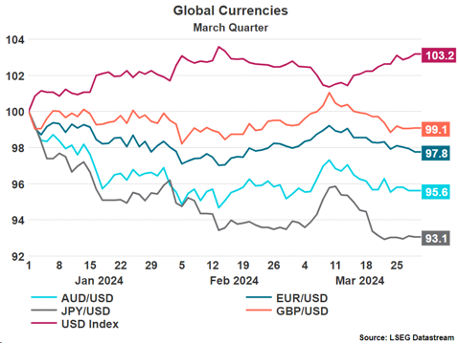

Australian Dollar

The Australian Dollar gained very little against the US Dollar in April, rising only 0.0154%, a negligible amount. This explains the small difference between the hedged and unhedged returns in international equities. While there was some volatility throughout the month generated by various data releases and central bank comments it ultimately ended with little change between the AUD and USD.

Most major currencies ended the month mostly equal with the start of the month with changes of less than 0.5%, the biggest mover being the Japanese Yen that has continued to depreciate, falling 3.9% against both the USD and AUD.

Commodities – Gold and Oil

Oil retreated just slightly in April by 0.13%. There was volatility earlier in the month as tensions flared between Israel and Iran but as these tensions eased and potential for a ceasefire in the Middle East increased the price of oil fell. Contrary to oil, Gold had another strong month, returning 4.88% in April. The price of gold rose in the first half of the month due to ongoing central bank demand for gold and escalating geopolitical concerns but the easing of these tensions in the back half of the month led the price to slide back from its mid-month peaks.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only and has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.